| |

Creekside

Bountiful, Utah Bountiful, Utah

Real Estate Real Estate

Company Background

Creekside Funding & Development, L.L.C. was established in April 2024 to spearhead the Silver Pines Resort project, a mixed-use development in Kellogg, Idaho. While the company itself has not operated previously, it is backed by the extensive experience of its founder, Chris Haertel, a veteran in real estate investment and development with 38 years in the industry. Chris’s expertise includes managing large-scale development projects through Regency Funding & Development, a private lending and development company that has funded over $400 million in loans and completed real estate projects totaling more than 400 million.

The company’s primary focus with this venture is the development of Silver Pines Resort, a 144-acre mixed-use property located near the renowned Silver Mountain Resort in Kellogg. This project aims to create a premier recreational and residential destination that leverages the area’s natural beauty and unique tourism appeal. The Silver Pines Resort will feature a mix of residential units, including a condo-hotel, townhomes, condominiums, and single-family estate homes, along with limited commercial spaces for restaurants, retail stores, and entertainment venues.

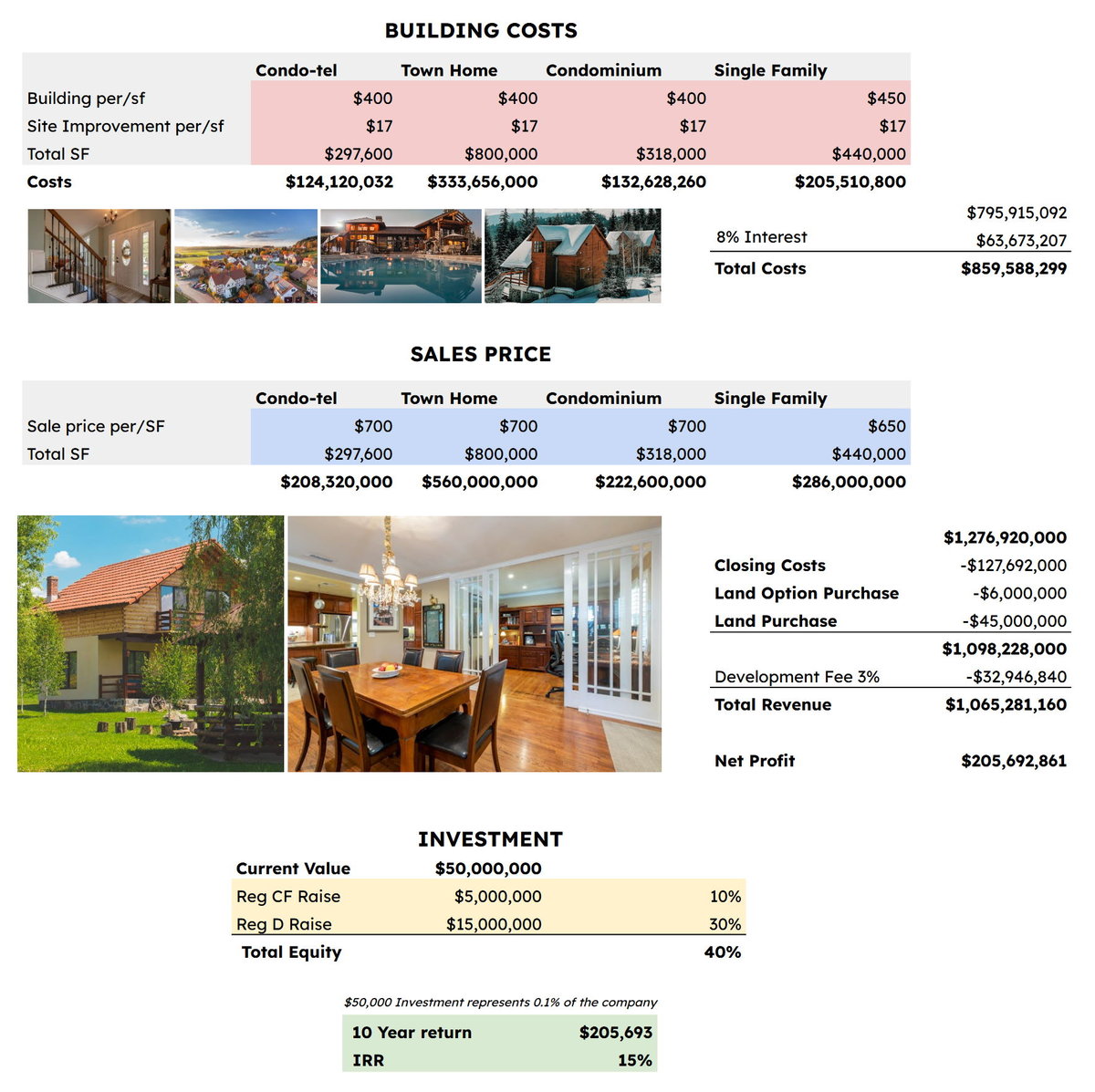

Creekside Funding Partners will contribute the full $50 million value of the land, which will serve as its equity stake in the project. Currently, the company owns half of the land and has secured an option to purchase the remaining portion. A portion of the $20 million in Phase I funding will be used to exercise this purchase option, thereby committing the full land asset to the joint venture. The remaining funds will finance essential infrastructure, including roads, water supply, and utility connections, to enhance the property’s overall value, which is projected to reach $80 million with horizontal buildout and a value of $1.1 Billion post-development.

Project Overview

Silver Pines Resort is strategically located in Kellogg, Idaho, near the popular Silver Mountain Resort. This positioning enables the project to attract both seasonal tourists and long-term residents. The initial funding of $20 million, raised through a hybrid of Regulation Crowdfunding (RegCF) and Regulation D (RegD 506c) offerings, will focus on finalizing land ownership and building critical infrastructure. By elevating the site’s development readiness, Creekside Funding aims to create significant value for future investors and position Silver Pines as a destination of choice in Northern Idaho.

KELLOGG, IDAHO KELLOGG, IDAHO

Kellogg is located in Shoshone County, Idaho. It received its nickname Silver Valley in 1880 after the discovery of the Bunker Hill mother lode and other large silver deposits, making it the largest silver mining center in the country at the time. From 1880 to 1982, vast deposits of silver, gold, lead and zinc were discovered and mined. In 1968 a group of locals formed a public corporation and sold shares of stock to fund their new ski area, Jackass Ski Bowl. It was known for its exceptional terrain and legendary powder skiing.

In 1987, Congress approved funding of $6.4 million to assist in the construction of the world’s longest Gondola. It originates in downtown Kellogg and ends 3.1 miles later at the Silver Mountain Ski Resort. The Silver Mountain gondola ride takes 19 minutes and travels 3,400 vertical feet along its journey.

In 2004, JELD-WEN Corporation purchased the Silverhorn Ski Area and renamed it the Silver Mountain Ski Resort. It joined forces with several small local developers, and they developed, among other things, Silver Rapids, Idaho’s largest indoor/outdoor water park and the 700-acre Galena Ridge Golf Community in nearby Smelterville.

|

Project Objectives

- Establish Silver Pines Resort as a year-round recreational and residential destination: Leveraging the scenic landscapes and tourism appeal of Kellogg, Idaho, the resort will offer a blend of luxury and affordability. This will attract a diverse market, from vacationers and retirees to outdoor enthusiasts and potential residents.

- Contribute the full $50 million land value as developer equity: This includes owning half the land outright and securing the remaining half through the purchase option, creating a substantial foundation for the project.

- Use the initial $20 million funding to establish approvals of infrastructure and acquire other properties needed for project: The funds will go toward completing land ownership, as well as constructing roads, water systems, and utility infrastructure, increasing the property’s value to an estimated $80 million and making it ready for further development.

- Create a scalable investment model: By utilizing a hybrid of RegCF and RegD offerings, Creekside Funding will raise the initial $20 million, providing retail and accredited investors with the opportunity to participate in a high-potential real estate project with future growth potential.

Market Analysis

Location and Demographics

Kellogg, Idaho – A Scenic and Strategic Location Kellogg, Idaho, is situated in Shoshone County and is part of the broader Silver Valley region, known for its rich silver mining history. Kellogg’s location is distinctive in that it combines historical significance with natural beauty, making it an attractive setting for outdoor activities and tourism. This transformation into a recreational destination began with the establishment of Silver Mountain Resort, which offers extensive skiing, hiking, mountain biking, and access to the world’s longest gondola ride. The town’s proximity to Interstate 90 provides easy access for visitors from nearby urban centers like Spokane, Washington, making Kellogg a convenient destination for both day-trippers and vacationers. Kellogg, Idaho – A Scenic and Strategic Location Kellogg, Idaho, is situated in Shoshone County and is part of the broader Silver Valley region, known for its rich silver mining history. Kellogg’s location is distinctive in that it combines historical significance with natural beauty, making it an attractive setting for outdoor activities and tourism. This transformation into a recreational destination began with the establishment of Silver Mountain Resort, which offers extensive skiing, hiking, mountain biking, and access to the world’s longest gondola ride. The town’s proximity to Interstate 90 provides easy access for visitors from nearby urban centers like Spokane, Washington, making Kellogg a convenient destination for both day-trippers and vacationers.

The region’s affordability is another significant advantage. Compared to other resort towns in Idaho, Montana, and nearby states, Kellogg offers lower property prices, making it an attractive alternative for vacation home buyers and retirees seeking scenic yet affordable properties. With rising real estate prices in traditional mountain destinations, Kellogg is poised to attract a growing demographic of budget-conscious tourists, investors, and residents.

Target Audience:

- Tourists and Outdoor Enthusiasts: Kellogg draws visitors who seek year-round recreational activities. Silver Pines Resort’s proximity to Silver Mountain and other outdoor attractions will make it a prime choice for tourists interested in skiing, hiking, and mountain biking.

- Second-Home Buyers and Retirees: As property prices in established vacation towns continue to rise, Kellogg offers an affordable alternative for second-home buyers and retirees looking for a peaceful, scenic environment.

- Retail Investors: Through RegCF, Creekside Funding is targeting smaller-scale investors interested in participating in a unique real estate project. The accessibility of RegCF investments allows individuals to invest in high-potential real estate without needing to meet accredited investor requirements.

- Competitive Landscape

The broader region around Kellogg includes several established resorts, yet few combine affordability and variety as Silver Pines Resort does. The property’s mixed-use development will cater to a broader range of visitors and residents, setting it apart from traditional single-focus resorts.

Uniqueness:

- Significant Value Addition through Infrastructure:

By investing in road construction, water, and utilities, Silver Pines Resort will increase its overall property value to an estimated $80 million. This increase in asset value enhances the project’s appeal for future investors and residents. By investing in road construction, water, and utilities, Silver Pines Resort will increase its overall property value to an estimated $80 million. This increase in asset value enhances the project’s appeal for future investors and residents.

- Potential for Casino Development: Given its location on Shoshone Tribal Lands, Silver Pines Resort may have the option to develop a casino, adding a unique entertainment component to the resort and further increasing its visitor appeal.

- Affordable Luxury: Offering a range of housing types at an accessible price point, Silver Pines Resort addresses market gaps in affordable luxury, making it suitable for vacation home buyers, retirees, and middle-income families.

Execution Strategy

Phased Development with Emphasis on Land and Infrastructure

The project’s phased approach ensures that each development stage builds upon the previous one, optimizing resource allocation and managing investment risk. Phase I will focus on securing land ownership and building essential infrastructure.

Phase I – Deployment of $20 Million Funding Land Purchase Option Execution: Creekside Funding Partners, a partnership owned by Chris Haertel, currently owns half of the property and holds an option to purchase the remaining half. A portion of the $20 million raised will be allocated towards exercising this purchase option, thereby committing the full $50 million land value as developer equity. Infrastructure Development: Roads and Access Routes: Roads and pathways will be constructed to provide internal connectivity, improving site accessibility and setting up the framework for future residential and commercial developments. Water and Utility Connections: Funds will be used to install essential utilities, such as water tanks, pumphouses, storm water facilities, water, sewage, and electricity. These improvements will make the site development-ready, adding significant value to the overall project and enhancing the property’s attractiveness to future investors. Marketing and Investor Relations: Marketing efforts will target potential buyers, renters, and future investors. Creekside Funding will leverage digital campaigns, public relations efforts, and partnerships with local tourism boards to boost visibility and attract early adopters.

Co-founder and Managing Member

Chris Haertel Managing Member Chris Haertel Managing Member

Chris Haertel brings over 36 years of experience in real estate investment and development, with a proven track record in managing and executing projects across various property types. Throughout his career, he has overseen the development of more than $400 million worth of real estate projects, including self-storage facilities, multifamily residences, office buildings, retail spaces, and industrial properties. His expertise spans the full spectrum of real estate activities, from property acquisition and capitalization to design and development, reflecting a deep understanding of the commercial real estate market.

Note: Note:

The information provided is a summary only. Please review the full offering documents (Form C) for a full description of the company and offering. The information provided is a summary only. Please review the full offering documents (Form C) for a full description of the company and offering.

You can cancel an investment commitment until 48 hours prior to the offering deadline. You can cancel an investment commitment until 48 hours prior to the offering deadline. |

|

| |

Bountiful, Utah

Bountiful, Utah  Real Estate

Real Estate